Traditional ira withdrawal tax calculator

Exceptions for Both 401k and IRA. Conversely the contributions to a traditional IRA are tax-deductible but are taxed on withdrawals after retirement.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Contributions are the money you deposit into the account up to 6000 a year for 2022 or 7000 if youre age 50.

. The Roth IRA is a retirement savers dream. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Open a Schwab Traditional IRA.

Contributions to a traditional IRA may or may not be tax-deductible depending on. Wages salaries and. For many people their biggest stash of savings is hidden away in tax-advantaged retirement accounts such as an IRA or 401k.

Making withdrawals before you reach age 59 12 means you will incur a 10 early distribution penalty on top of any income taxes that are due though there are some exceptions. Use this calculator to determine the max you can invest. A person can make an annual contribution to a Traditional or Roth IRA at any age as long as they have earned income.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. The basic difference between a traditional and a Roth 401k is when you pay the taxes. Call 866-855-5635 or open a Schwab IRA today.

If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. But before you open an account you need to understand the differences between a Roth IRA and a traditional IRA.

529 State Tax Calculator Learning Quest 529 Plan. Government imposes a 10 percent penalty on. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties. See Roth IRA withdrawal rules. Also you may owe income tax in addition to the penalty.

Call 866-855-5635 Chat Professional Answers 247 Visit. With a Roth IRA there are no required distributions as there are with a Traditional IRA. The Roth IRA five-year rule mandates a five-year waiting period for tax-free withdrawals of earnings.

Traditional IRA Calculator can help you decide. Individual retirement accounts IRAs are a key part of your retirement strategy. Roth IRA are not tax-deductible but the withdrawals after retirement are tax-free.

In addition to non-taxable contributions to a Traditional IRA TIRA discussed in a previous article investors can contribute additional after-tax funds to their TIRAs which can not be deducted from ones federal tax liability. To which type of IRA plan and how much can be contributed or can be treated as tax deductible is influenced by many factors. Also you may be able to deduct traditional IRA contributions.

You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as. As long as money placed in a traditional IRA is below the annual contribution limit 6000 for 2021 and 2022 or 7000 if youre 50 or older interest you earn in a given tax year may be tax. Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½.

Traditional IRA account holders can roll as much money as they want from an existing traditional. You die or become permanently disabled. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe taxes at your current tax rate on the amount you withdraw. Were here to help. Earnings in these accounts can accumulate either tax-free or taxed at a later date.

If you have a traditional individual retirement account IRA your money grows tax-deferred until you withdraw it. For example if you are in the 22 tax bracket your. Exceptions to the Early Withdrawal Penalty.

With a traditional 401k you make contributions with pre-tax dollars so you get a tax break up front helping to lower your current income tax bill. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation. If youre at least age 59½ and your Roth IRA has been open for at least five years you can withdraw money tax- and penalty-free.

Your moneyboth contributions and earningsgrows tax-deferred until you withdraw it. The money in your Roth IRAs consists of two kinds. Traditional IRA depends on your income level and financial goals.

Choosing between a Roth vs. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings. Two common types of IRAs are traditional IRAs and Roth IRAs.

Learn more about Traditional IRA withdrawal rules Have more questions. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. Traditional IRA calculator.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Here are few basic points about those types of contributions as well as few real-life questions about non-deductible TIRA contributions that I. You can get a traditional IRA if you receive taxable compensation.

Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

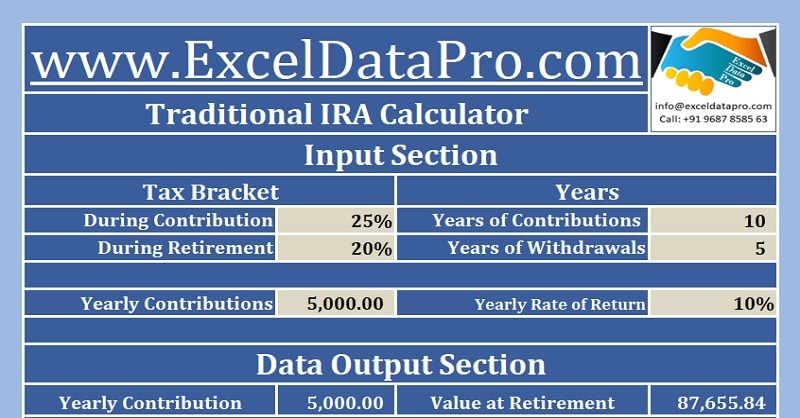

Download Traditional Ira Calculator Excel Template Exceldatapro

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Retirement Withdrawal Calculator For Excel

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Compute An Ira Minimum Withdrawal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal